Summary

In a nutshell

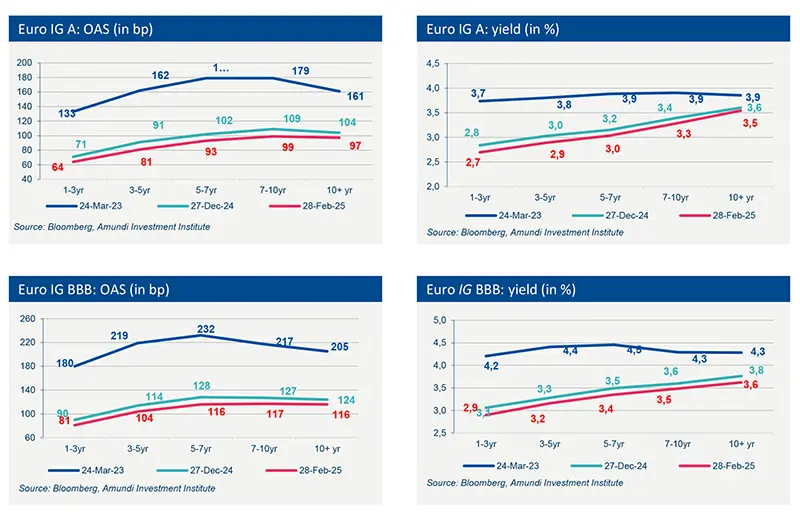

Euro credit markets held up relatively well to the huge rise in sovereign yields. The German 10-year bond climbed to 2.9%, a 50 bp increase in less than two weeks. During this period, Euro IG spreads tightened and Euro HY spreads remained virtually stable. Following the increase in risk-free rates, Euro IG and HY yields rised to 3.3% and 5.5% respectively.

The sharp rise in interest rates is due to the announcement of Germany's massive €500 billion investment plan and upcoming spending in the defense sector. The German government wants to lift the debt brake restrictions and release funds to finance the country's defense and infrastructure. Furthermore, Europe will have to spend more to finance its defense as the United States threatens to reduce its security commitment to the EU. European leaders have agreed on an €800 billion rearmament plan.

In this climate of high uncertainty, the ECB has adopted a more cautious tone regarding upcoming rate cuts. Christine Lagarde warns in particular of the inflation risks linked to increased spending on defense and infrastructure. The ECB still considers monetary policy to be "restrictive" but "reasonably less restrictive to the extent that rate cutsmake newborrowing cheaper for businesses and households".

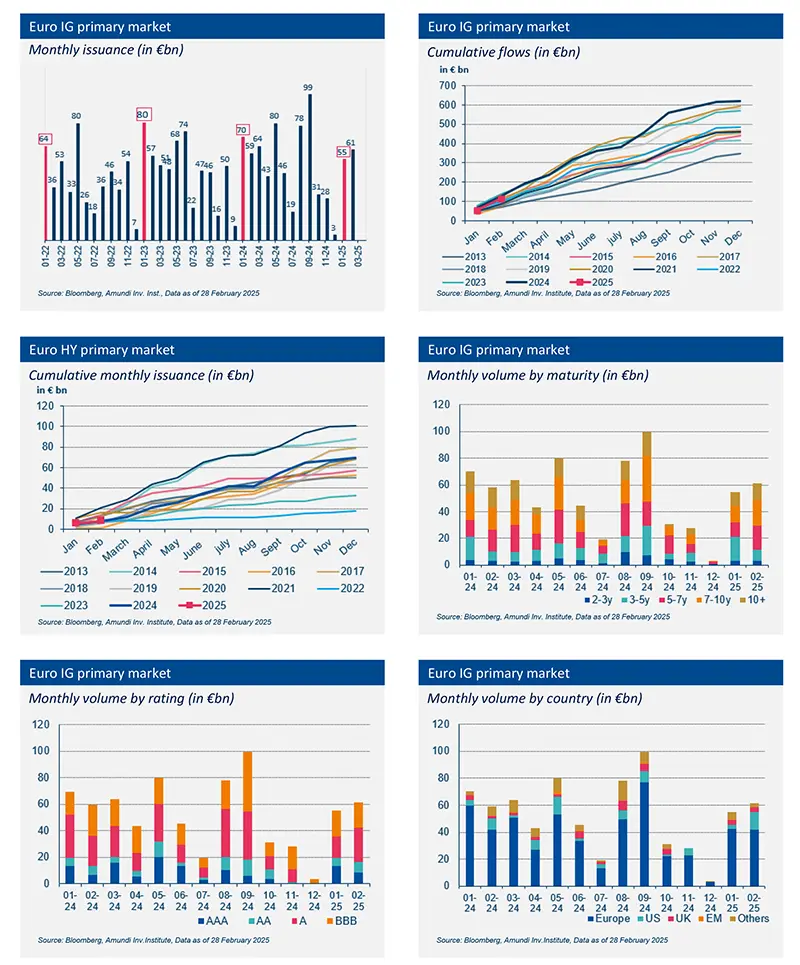

In the primary market, investor appetite remains strong, but growth fears linked to US tariffs could bring some volatility andmore selectivity from investors.

Primary market Investment Grade

Market data

Find out about our treasury offer