Summary

Highlights

- China’s policy makers are ready to provide additional easing should domestic consumption fail to improve.

- The recent news of the development of Chinese cheaper AI systems has lifted sentiment in the Chinese tech sector.

- Weakness in US markets may boost foreign investors’ appetite for China and other emerging markets such as India.

In this edition

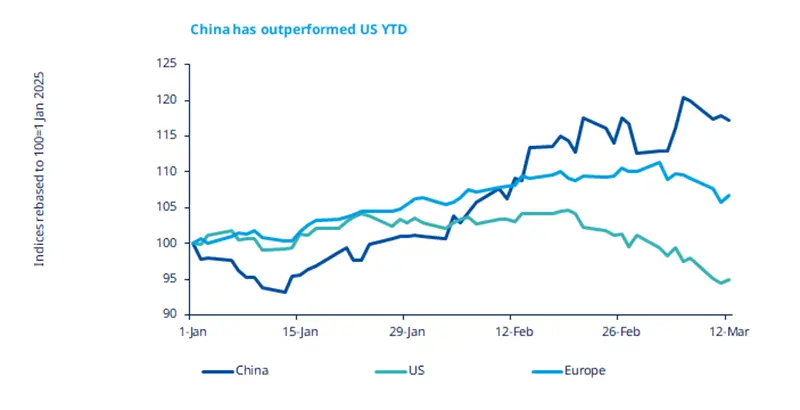

US equities underperformed other main global markets so far this year due to concerns about the health of the US economy, in light of the erratic statements by President Trump on tariffs, and recent weak economic data. This has led to a strong rotation out of US mega caps into Europe and China equity. Europe has benefitted from recent announcements on defence spending plan and talks towards a ceasefire in Ukraine. In Asia, Chinese equities’ performance has been even stronger, benefitting from the supportive policy stance, despite uncertainty on US tariffs. The arrival of DeepSeek and its cheap AI (artificial intelligence) model has also played a key role in supporting China’s tech sector, which has been the main contributor to the China rally.

Key dates

US retail sales, Brazil GDP

Fed monetary policy, Bank of Japan policy, EZ CPI

Bank of England rate, South Africa policy rate

Read more